The interbank rate, also known as the interbank lending rate, is the interest rate charged on short-term loans between banks. It plays a crucial role in the financial system, influencing borrowing costs, liquidity, and overall economic activity. Understanding the price trend of interbank rate is essential for financial institutions, investors, and policymakers to make informed decisions. This article provides a comprehensive analysis of interbank rate trends, examining the factors influencing these trends, regional variations, and future market forecasts.

Market Overview

The interbank rate is determined by the demand and supply of funds in the interbank market, where banks lend to each other to meet short-term liquidity needs. Key interbank rates include the London Interbank Offered Rate (LIBOR), the Euro Interbank Offered Rate (Euribor), and the Federal Funds Rate in the United States. These rates serve as benchmarks for various financial products and are influenced by central bank policies, economic conditions, and market liquidity.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/interbank-rate-price-trends/pricerequest

Current Interbank Rate Trends

The interbank rate market has shown variability due to various economic and financial dynamics. Several key factors contribute to these trends:

-

Central Bank Policies: Central banks play a crucial role in setting the baseline for interbank rates through their monetary policy actions. Changes in policy rates, such as the Federal Funds Rate or the European Central Bank’s main refinancing rate, directly impact interbank rates.

-

Economic Conditions: The overall health of the economy influences interbank rates. During periods of economic growth, demand for credit increases, leading to higher interbank rates. Conversely, during economic downturns, central banks may lower rates to stimulate borrowing and investment.

-

Market Liquidity: The availability of liquidity in the banking system affects interbank rates. Higher liquidity typically results in lower rates, while tighter liquidity conditions can drive rates higher.

-

Inflation Expectations: Inflation expectations influence central bank policies and, subsequently, interbank rates. Higher expected inflation often leads to higher rates as central banks seek to curb inflationary pressures.

-

Geopolitical Events: Political stability and geopolitical events can impact market confidence and liquidity, influencing interbank rates. Events such as financial crises, wars, and significant policy changes can lead to rate volatility.

-

Regulatory Changes: Regulatory developments, including changes in capital requirements and liquidity coverage ratios, affect banks’ lending behavior and interbank rates.

Regional Variations in Interbank Rates

Interbank rates vary across different regions due to local economic conditions, central bank policies, and market dynamics. Here is a regional analysis of interbank rates:

-

North America: In the United States, the Federal Funds Rate is the key interbank rate, influenced by the Federal Reserve’s monetary policy. In Canada, the Canadian Overnight Repo Rate Average (CORRA) serves a similar function. Both rates are closely watched by market participants and are indicative of broader economic conditions.

-

Europe: The Euro Interbank Offered Rate (Euribor) is a critical benchmark for interbank lending in the Eurozone. It reflects the rates at which banks offer to lend unsecured funds to one another and is influenced by the European Central Bank’s policies.

-

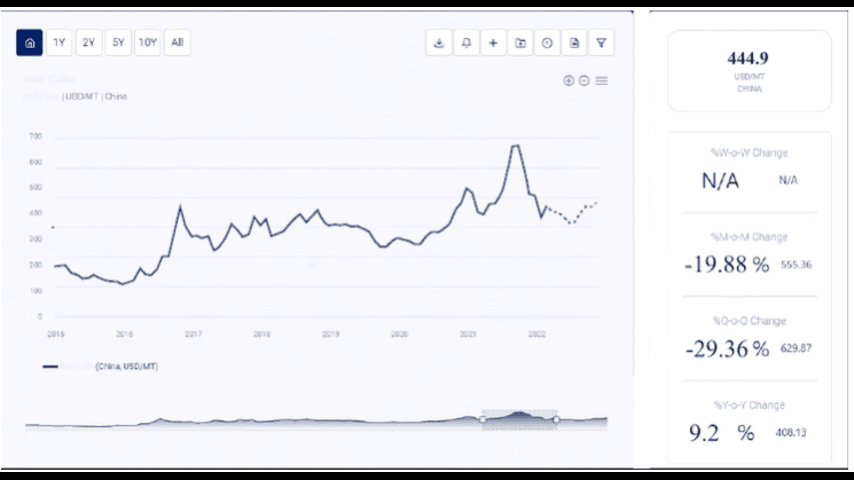

Asia-Pacific: In the Asia-Pacific region, key interbank rates include the Tokyo Interbank Offered Rate (TIBOR) in Japan and the Shanghai Interbank Offered Rate (Shibor) in China. These rates are influenced by the respective central banks’ monetary policies and regional economic conditions.

-

Latin America: In Latin America, interbank rates are influenced by local central bank policies and economic conditions. Rates such as the Interbank Interest Rate in Brazil and the Tasa de Interés Interbancaria de Equilibrio (TIIE) in Mexico are significant benchmarks.

-

Middle East and Africa: In these regions, interbank rates are influenced by central bank policies and regional economic conditions. Rates such as the Saudi Arabian Interbank Offered Rate (SAIBOR) and the Johannesburg Interbank Agreed Rate (JIBAR) are key benchmarks.

Factors Influencing Interbank Rates

Several factors play a crucial role in determining interbank rates:

-

Central Bank Policy Rates: The policy rates set by central banks serve as a foundation for interbank rates. Changes in these rates directly impact interbank lending costs.

-

Economic Growth: Economic growth influences demand for credit and overall market sentiment, affecting interbank rates. Strong growth typically leads to higher rates, while economic slowdowns result in lower rates.

-

Inflation: Inflation expectations affect central bank policies and interbank rates. Higher inflation leads to higher rates as central banks aim to control price stability.

-

Market Liquidity: The availability of liquidity in the banking system influences interbank rates. Ample liquidity leads to lower rates, while tight liquidity conditions result in higher rates.

-

Banking Sector Health: The financial health of banks affects their willingness to lend to each other. A stable banking sector leads to lower interbank rates, while financial distress can drive rates higher.

-

Geopolitical Stability: Geopolitical events and political stability impact market confidence and liquidity, influencing interbank rates.

Applications of Interbank Rates

Understanding the applications of interbank rates can provide insights into their significance in the financial system. Some of the primary applications include:

-

Benchmarking Financial Products: Interbank rates serve as benchmarks for various financial products, including loans, mortgages, and derivatives. They are used to set interest rates on these products.

-

Monetary Policy Transmission: Interbank rates are a key mechanism through which central banks transmit monetary policy decisions to the broader economy. Changes in interbank rates influence borrowing costs and economic activity.

-

Risk Management: Financial institutions use interbank rates for risk management purposes, including interest rate risk and liquidity risk. They are critical in pricing and hedging financial instruments.

-

Investment Decisions: Investors use interbank rates to assess market conditions and make informed investment decisions. Changes in rates can impact the attractiveness of different asset classes.

Future Price Forecast

The outlook for interbank rates depends on several factors:

-

Central Bank Policies: Future changes in central bank policies will significantly impact interbank rates. Expectations of rate hikes or cuts will drive market movements.

-

Economic Recovery: The pace and sustainability of global economic recovery post-COVID-19 will influence demand for credit and interbank rates.

-

Inflation Trends: Ongoing inflation trends will affect central bank decisions and, consequently, interbank rates.

-

Geopolitical Stability: Geopolitical developments, including conflicts and trade policies, will impact market confidence and interbank rates.

-

Technological Advancements: Advances in financial technology and changes in market infrastructure may influence interbank lending practices and rate setting.

Conclusion

The interbank rate market is influenced by a complex interplay of factors, including central bank policies, economic conditions, market liquidity, and geopolitical events. Understanding these dynamics is crucial for financial institutions, investors, and policymakers to navigate the financial landscape effectively.

By staying informed about the key factors influencing interbank rates and monitoring market developments, stakeholders can make strategic decisions and optimize their financial strategies. As the global economy continues to evolve, the importance of interbank rates as a benchmark and a tool for monetary policy transmission will remain significant.